A forty years old Adam who was barely making his ends meet with a wife, two children, and a frail mother at home, had to undergo a severe crisis when his mother met with an accident. She has to be treated with surgery and Adam has got no money for that.

Families like these usually have no savings or any insurance. Better than asking their friends or relatives, they find bank loans more convenient. And, due to some reason, if they could not get it, they are in a deep quagmire.

There might be several occasions where your request for a personal loan can be rejected and you cannot help but think how miserable your life is. In helplessness like this, do not forget where there is a will, there is a way.

To make sure you do not delve into any such situation, certain applications like PayDay Say cash advance apps for money 24/7, can be downloaded on mobile phones with just one click.

Source: wishfin.com

Table of Contents

Reasons For the Rejection of Loan

Amongst several reasons, you will know the top ten occasions on which your request for a personal loan can be rejected.

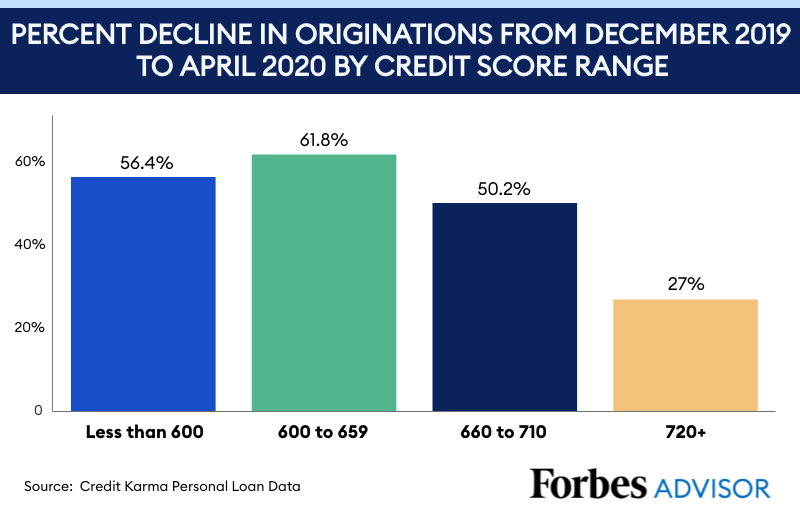

Statistics show that on average 76% of consumers who apply for a personal loan are declined. And one of the main reasons is a low credit score.

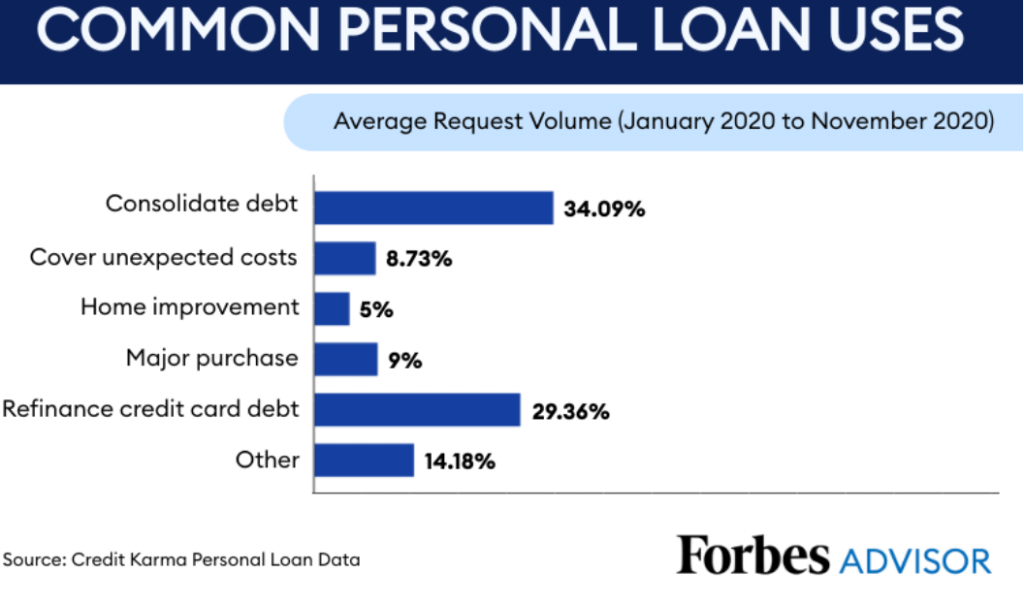

People take personal loans for different purposes, from the big reasons like making your house or buying your car to small reasons like paying hospital bills or kids’ high school fees. They are intended to provide you with a helping hand in your time of need.

#1 Forms Filled up Wrongly

One reason that your application might be rejected is that you have not filled the form well. You have made mistakes, provided wrong answers, or concealed something due to which the accounts office could not accept.

#2 Non-Credible Borrower

Your history of loans return is important. If you took a debt in the past and did not pay that without causing any trouble, you will not be trusted again. A person has to be very much credible to get the loan.

#3 Employment Institution Dilemma

The limited funds from your employment institution. They might not have enough money to lend you the loan and your request would be rejected. You must consider your dilemmas when applying for a loan.

#4 Incomplete Documentation

If you fail to provide all the requisite documents, the authorities will never consider your application. You need to submit full documents in an order to be acceptable to them.

#5 Failure to Comply with Eligibility Criteria

The fifth reason due to which your application for a personal loan will get rejected is that you fail to comply with the eligibility criteria for lending debt. If this is the case, there is no chance for you to get financial assistance.

#6 Current Employment Status

Pay attention to your employment status, banks or any other accounts office need to check if you get income every month. They might ask you for your employment details for the past few months.

#7 Current Citizenship Status

People living in foreign countries might find difficulty in the approval of loans due to their citizenship of another country. Lenders need to check certain years of residential status to approve your application.

#8 Elevated FOIR

Elevated Fixed Income to Obligation Ratio (FOIR) means that if your money is already being paid monthly for other important obligations such as EMIs, then you will not be trusted with another debt.

#9 Huge Influx of Loan Borrowers

Also, a factor in your request rejection can be a huge influx of loan borrowers which results in the acceptance of just some borrowers. There is always a possibility for your cancellation of the application in such cases when you try to lend money from a bank or other sources.

#10 Unreachability

The last reason for your loan rejection is your unreachability. The accounts office might be trying to contact you. And in case you are not responding to their calls or messages due to any reason, your request will be automatically declined then.

Way Forward

These are some occasions when your request for a personal loan may be rejected. If any such thing happens to you, do remember that you can still make your way out and that is through the online applications that give out loans.

These apps aim to help you in your financial crisis by providing money as soon as you put a request for it. These are quick and convenient, and extremely popular among people.

The application form is filled online and easy access to loans is granted without any hidden fees. You can easily manage your budget by using them. Such apps take your information of bank accounts to check if you are a reliable borrower. You can easily get money from fifty to a hundred dollars. It helps you greatly in managing stress by giving you financial relief.

You need to still avoid any mistakes that can lead you to the rejection of a personal loan. You can mitigate such chances by providing correct information to the bank, being available at the given contact number, submitting all the required documents, and considering eligibility criteria seriously.

You can also do that by being vigilant while filling up your forms, by writing correct names and numbers. Just try to keep in mind these occasions, be highly attentive, and you reach success.