Various forms of payments are prevalently used today. Some forms are as simple as handing over money while some require meticulous filling of information. Before you start buying business deposit slip to cash your checks, you need to understand how check payments work.

Table of Contents

Why Check Over Other Payment Modes?

With so many modes of payments available, why do people still choose to carry around a piece of paper as a form of payment?

First of all, checks are easier to carry as compared to large sums of money. It is safer than carrying cards since you get time to cancel a check if it gets misplaced but a card can be swiped as soon as it gets stolen.

The processing time involved in check payment makes it easy for some to gather sufficient funds to ensure that the payment is accepted. By the time a business deposit slip is accepted by the bank, the payer can contact the bank if there has been any mistake.

Many businesses and individuals also issue post-dated checks as a promise of payment if funds are short at the time of the check being issued. Since there is no payment gateway involved, there are no fees charged for the transaction.

The many advantages of check payments still make check payment a predominant payment process.

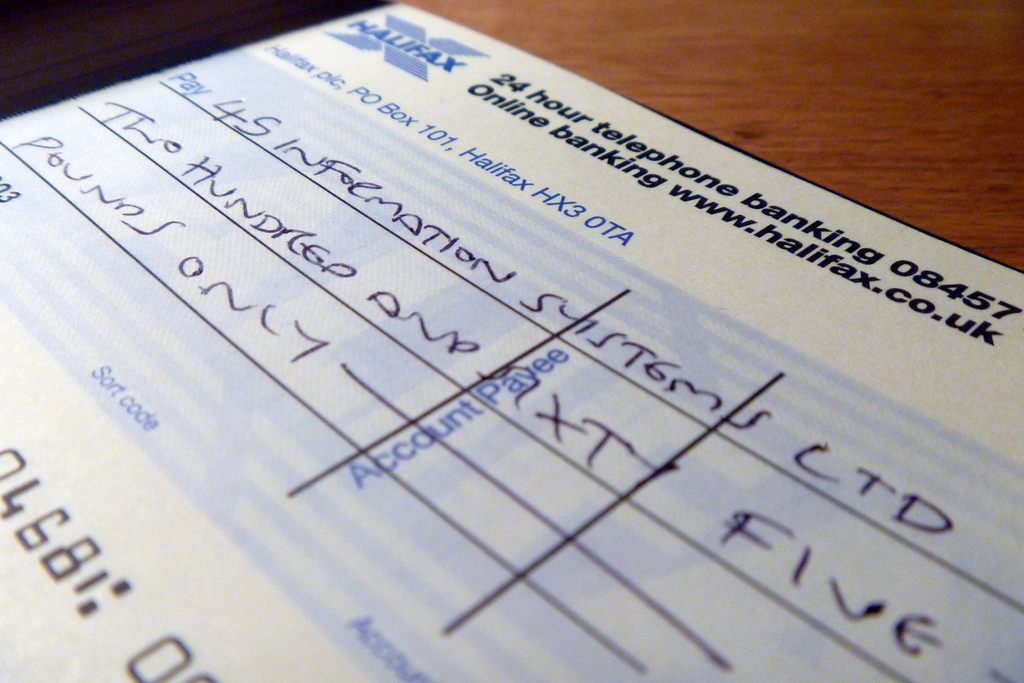

How to Pay Using a Check

Some businesses and individuals set up their own check payment system.

Blank checks, as well as computer checks, are easily available online. Along with the check paper, there is the need to have a printer and a check printing software. QuickBooks is a popular RPA software that helps perform all kinds of accounting functions along with check printing.

So, to print a check all you need to do is have all the tools needed to print a check.

Keep a printer ready to print your checks. Using your check printing software, you can complete the printing process. Once the check is printed, you need to authorize the check using an endorsement stamp. Some businesses provide business deposit slip with their check payments to make it easier for the payee to deposit the check.

A check printing set up is crucial for businesses and individuals who make check payments regularly.

How to Cash/Deposit a Check

If you are on the receiving end of a check payment, then you need to know how to cash or deposit the check. Before you fill a business deposit slip, you need to decide whether you want to cash the check or deposit it. When you cash a check, the bank will hand over money to you, but if you deposit it, then the amount will get transferred to your bank account.

Before you take the check to the bank, you can verify the check to ensure that the payee has enough funds for the check not to bounce. Once you have verified the check, you can fill out the business deposit slip. Take the check and the slip to your bank and deposit it to a teller. You can also deposit a check online.

Payment process involving a check is easy and convenient for the payer and the payee. So, it is wise to have both check and business deposit slip in stock for payments.