Is your website giving visitors what they want? Offering your consumers an array of options at check-out time is essential for building trust with your clients and making your merchant site flourish. If you want to expand your online market and drive revenue, you’ll need to know exactly how payment options like EMV solutions can help and how to integrate them the smart way.

Table of Contents

How Restrictions in Basic Payment Options Are Hurting Your Business

Remember when you designed your business website? Each aspect of the aesthetic, layout, and design you incorporated was built specifically with the consumer in mind. You wanted their experience to be as simple and easy as possible, so they would head right on over to the checkout page and make a purchase.

But what happens when they can’t? They navigate to the competition and make a purchase there. According to surveys, 50 percent of customers reported that they would leave a website if that website didn’t offer their preferred payment method. This means that half of your potential consumer base won’t make an exception for you. You need to make yourself available to them, instead.

As an online business owner, it’s smart to think of payment options in terms of site usability. Your website can be as streamlined as possible, with lightning-fast loading speeds and easy navigation—but even if it fits all the criteria for a user-friendly portal, it’s not friendly to a user if that user can’t actually use it to make a purchase.

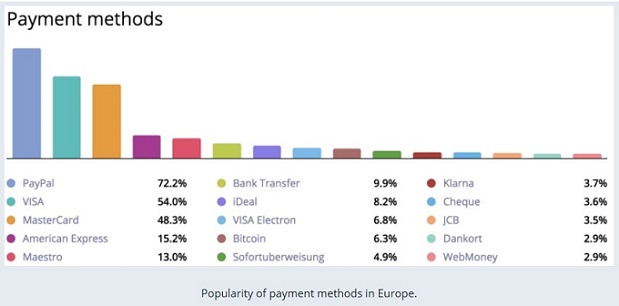

If people can’t pay with your current options, they won’t use your site, and you’ll lose out on business. However, you can fix that problem by adding additional payment options. There are a variety of alternative payments that are becoming popular these days, including bank transfers, prepaid cards, charge cards, cryptocurrency, all kinds of digital wallets, and mobile payments.

How to Use Alternative Payment Options to Expand, Drive Revenue & Build Trust

Still undecided about hopping on the bandwagon with more payment options for your customers? It’s important to consider exactly how they can help your business grow. The truth is that your checkout page and the options available there can make or break you when it comes to expanding into new markets and building that sweet, revenue-driving trust which makes a business stand out online.

How does it work? When consumers are in the final stages of buying at the checkout page, you already know that they’re searching for a specific type of payment method they know and trust. This makes checkout faster and easier for them, but it also eliminates any stress new customers may have about payment security. If they have experience with a certain method and have learned that they can depend on it, that trust will extend to you as well because you’re offering a vetted option. This will help build your online reputation and get you ready for the next step: market expansion.

If you’re looking to expand your market overseas, alternative payments areessential. That’s because different geographic regions rely on different payment methods to complete their online transactions, and credit cards are no longer the go-to payment method for many countries. For example, The Netherlands relies mainly on iDeal to make purchases, while Chinese citizens prefer Alipay. By integrating the correct types of payment for the location you’re trying to target, you can maximize your sales and build trust within the new market.

To understand how payment options can aid in online business growth, we can examine it on a larger scale with the popular online gaming website 888 casino NJ and their recent expansion into the United States. Not only can US-based consumers find traditional payment options on the site, but there are alternative and geographically-specific options as well. This menagerie of choices caters to a wider demographic within the specific targeted location, covering all the bases for connecting with the new client base.

Integrating Alternative Payment Options into Your Website the Smart Way

Before you add as many payment options as possible to your website, there are a few things to consider. Integrating a payment method(and a payment gateway you can use to operate from) should not be taken lightly, and you should be absolutely certain that it will benefit your consumers and your company before you decide to take the plunge.

Integrating payment options can be a costly affair, so do your research ahead of time. This doesn’t just entail you thinking about it, either—you need to ask your customers what they think. Create a poll among your paying customers and query them about their satisfaction with the current options. If it isn’t broken, you don’t need to fix it. However, if enough people say they want more options, give them what they want.

If you are trying to reach a new market, this goes double. Search for a payment provider that will bridge the gap between currencies to make international transactions a reality for your business, but don’t let that be the last step. You need to know which specific payment options are the most popular in each country, and also throughout the regions within that country.

You must integrate options that consumers are able to use and that they will use, or there’s no use in trying to expand. They won’t make an exception for your products if the competition has similar wares yet allows them to shop the way they truly want.

Furthermore, learn about which currencies are becoming more popular, like Bitcoin and other cryptocurrencies. If you want to cater to a younger crowd or other markets that favor them, accepting cryptocurrencies could make you stand out above the rest.

Finally, make sure that adding on the payment options your clients seem to want will not hurt your business in any way.But remember, the whole process must stay completely legal and hassle-free. You don’t want any issues with international banking laws on your hands, and you want your customers to feel 100 percent safe using your services.

Now that you know the benefits of having multiple payment options on your site, you can begin to drive revenue, build trust, and expand your market into new territory. It’s easier than ever to give your business a boostand please your customers, so what are you waiting for? Start giving them what they want today.