There are many people who acquire a loan that is too expensive. After a certain amount of time has passed, they realize that it is too much of a risk to continue making loan repayments and decide to apply for refinancing their existing loan.

This is fairly common nowadays as the financial circumstances of the applicant may have changed since the loan was acquired initially or the applicant has found a new loan with much better loan terms available. One of the main benefits of refinancing your loan is that you can potentially manage your existing debt in a much more efficient manner. You can quickly find the best rates when refinancing by using a student loan calculator.

Table of Contents

What is the Student Loan Refinancing Process?

When you get your loan refinanced, the lender will replace your existing loan with a new one. The new loan must have better features, terms and conditions when compared to your prior loan. The most beneficial factor is that by refinancing your loan, you can significantly improve your financial situation. Each lender has their own eligibility criteria and regulations depending on the type of loan you want to get refinanced. It is advisable to apply for this process if you have been considering the following.

- If you have an existing loan that has become too much of a burden and if you are looking to improve the loan terms in a way that is beneficial for you.

- If you are comparing lenders to find who is offering better loan terms than the loan you currently have.

- If you apply for refinancing and the new loan is approved, it will completely pay off your existing debt.

- If you make regular loan repayments toward the existing loan until you get approved for refinancing it.

There are certain factors that you can improve in order to ensure your loan gets approved for refinancing, these are listed below.

- It is advisable to handle any existing credit issues you may have as lenders will check your credit score. If you have a good or above average credit score, this could result in you being offered the lowest interest rates.

- Conduct your own research into the lenders that offer loan refinancing as you can gauge to see how different interest costs could change depending on the type of loan.

- Narrow down the top 3 qualified lenders who are offering the best loan terms. Get a quote from all 3 and then compare it with what their competitors are offering. This way, the lender will perceive you to be a responsible borrower.

- Refrain from availing any new credit at the time of the refinancing process. This includes acquiring a new credit card as well or anything that can have a negative role on your credit score.

How to Find the Best Student Loan Refinancing Lenders?

After you have finalized on the 3 best student loan refinance lenders, consider the following questions when choosing the right one for you. These are listed below.

- How much can I save with the interest rate they are offering?

- Is the lender offering fixed or variable interest rates?

- What is the monthly repayment plan and if it will affect your other expenses?

- What are the additional features the lender is offering?

- What is the reputation of the lender?

- Were the previous applicants satisfied with the lender? Feedback, if any.

- Does the lender charge a prepayment penalty or an origination fee?

- Does the lender have good customer support?

- What is the lender’s minimum and maximum amount of debt for refinancing loans?

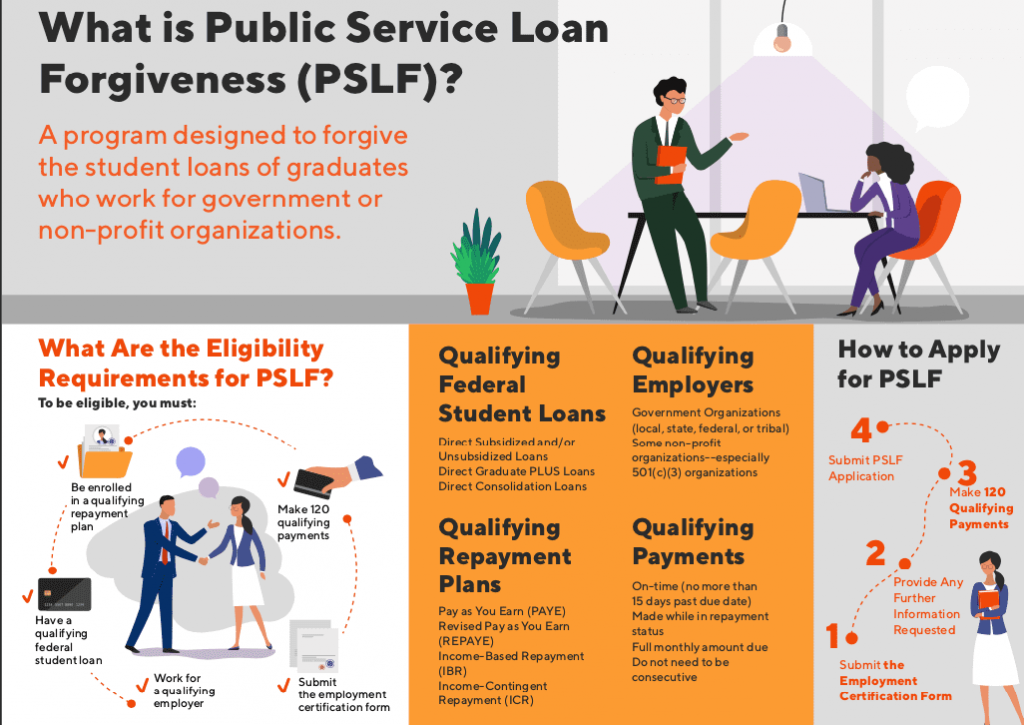

What is Student Loan Forgiveness and How Does it Work?

Student loan forgiveness is a program where student loans are partially or fully discharged as long as the applicant meets the eligibility requirements and fulfills certain conditions. These loan forgiveness programs were specifically designed in order to make attending college more accessible to the people willing to do extra work.

These student loan forgiveness programs are available through non-profit organizations, government agencies and colleges. If you are employed in these organizations, you can ask for more information on the loan forgiveness programs and their terms and conditions for approval.

These loan forgiveness programs were initiated to reward people who join specific branches such as the military, people who regularly perform volunteer work and participate in an NGO charity drive, hold employment in some government jobs or the people who work as doctors, nurses, lawyers and teachers. The loan amount that can be forgiven will vary from lender to lender and largely depends on which forgiveness program is chosen.

Which Employers Qualify for the Public Service Loan Forgiveness Program?

The Public Service Loan Forgiveness program (PSLF) program can be availed by people who are currently employed in the following sectors.

- Government organizations at federal, state, local and tribal levels.

- All non-profit organizations that are exempted from tax under Section 501(c)(3) of the Internal Revenue Code.

Who Cannot Apply for the Public Service Loan Forgiveness Program?

- Partisan political organizations.

- For profit organizations.

- Labour Unions.

- Non-profit organizations that are not exempted from tax under Section 501(c)(3) of the Internal Revenue Code.

People who work for the above listed employers will not be eligible to claim the Public Service Loan Forgiveness program.