StocksToTrade (STT) was established in 2009 as a trading platform built for traders, by traders. This instantly sets it apart from other trading platforms which are oftentimes laden with technicalities, and complicated functions. With STT, everything is provided in one place. Whether you’re a penny stocks trader, or you prefer to dabble in blue-chip stocks, STT delivers. Our experts are enamored with StocksToTrade because it completely demystifies the stock market. This is great news for anyone who wants to become a day trader. Thanks to STTs SteadyTrade, it is possible to enjoy live training sessions with webinars, Monday through Friday, attentive customer support, and on-the-go trading.

Trading stocks is inherently challenging. It is definitely not a cakewalk, irrespective of the trading platform you choose, or the broker you go with. However, the brains trust behind StocksToTrade has made a point of providing an in-depth education to help maximize your chances of success. They do this through the expert insights and analysis of Tim Bohen, and his teams of pro traders who are standing by to mentor other traders. StocksToTrade focuses on what are known as volatile stocks. These financial instruments reflect maximum price movements on the day. With the right strategies in place, it is possible to profit from volatile stocks. If you find yourself stuck, prime broker services can help hedge funds manage risk, monitor your portfolios, maintain liquidity and build your business.

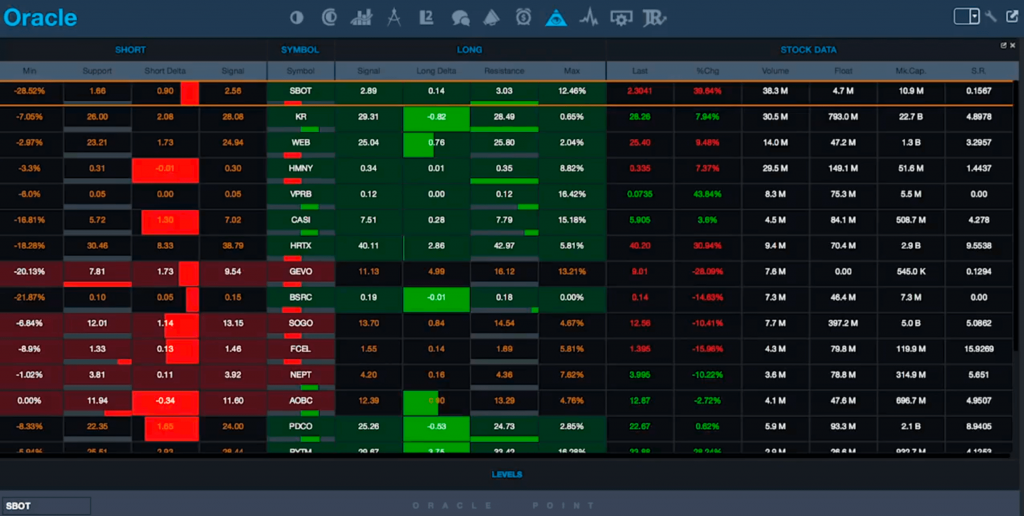

StocksToTrade is a single trading platform. All that’s needed is a username/password to access all the features. Fortunately, you can access real-time data on all available stocks at the click of a button. This includes pricing, SEC filings, ownership and management, earnings reports, and economic data releases. With tens of thousands of stocks trading weekly, STT simplifies the process of watching stocks (screening stocks) so that you can identify lucrative trading opportunities. The most useful resource at this trading platform is known as Oracle. Proprietary technology allows traders to automatically scan the stock market and automatically pick stocks with the biggest gains on the day. These present traders with the best possible trading opportunities.

Table of Contents

StocksToTrade Compatible Brokers and Costs

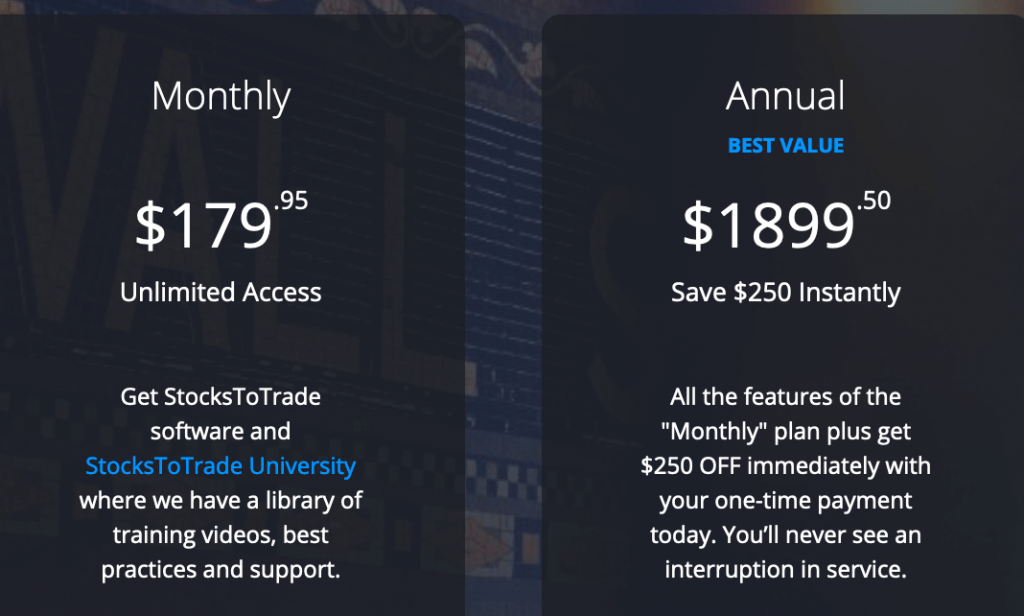

Source: StocksToTrade Plans

It’s worth reiterating that STT is not a brokerage; it’s a trading platform. It can easily be integrated with several brokers, including: E*TRADE, Tradier Brokerage, Interactive Brokers, TradeStation, TD AmeriTrade, and RobinHood. It’s really easy to integrate your broker with the trading platform, and if you encounter any issues, you can simply watch the tutorial. There are two basic trades available, with a monthly pricing option at $179.95, and an annual option at $1899.50. If you pick the annual option, you enjoy immediate cost savings of $250. Traders get to enjoy all the features of the monthly plan, including access to training videos and around-the-clock support. We highly recommend starting off with a 14-day trial of the trading platform at a cost of $7. This gives you instant access to the financial markets, with everything in one place.

How Does Oracle Work?

Source: StockstotradeTop % Gainers Instagram (September 17 2020)

Oracle is a proprietary algorithm (crafted by STT engineers and professional stock traders) which automatically ‘scans’ the markets for the biggest moves. Volatility is a phenomenon that allows traders to generate profits to the upside or downside. With StocksToTrade (STT), all the bullish price movements (rising prices) are listed in green. All the bearish price movements (falling prices) are listed in red. Traders typically place call options if they believe the price of the stock is going to rise in the future, or they place put options if the price of the stock is expected to decrease the future.

Source: StocksToTrade Oracle Proprietary Algorithm

Either way, profits stand to be generated if the trader calls it correctly. It’s difficult analyzing the stock market for the biggest movers, or the most volatile stocks. One way around this is by registering for an account on the STT platform. Thanks to Oracle, it is easy to evaluate the performance of past big winners, and juxtapose that against similar stocks under similar conditions. While certainly not a guarantee of future performance, Oracle represents strong similarities. To enhance the success of your trades, it’s a good idea to apply your stock trading education. Careful analysis of technical and fundamental factors can assist in this regard.

More specifically, Oracle narrows down tens of thousands of stocks into a handful of stocks, typically 15. By doing this, STT automatically allows you to focus on a much smaller pool of equities. A combination of technical and fundamental analysis of a handful of stocks can prove to be extremely valuable in this regard. In fact, many traders will pick just a couple of stocks to track and trade. These volatile stocks show the most promise, that’s why Oracle is such a useful resource for you to use. In our estimation, it is certainly one of the best automated recommendation trading engines out there, since it tracks multiple variables simultaneously.

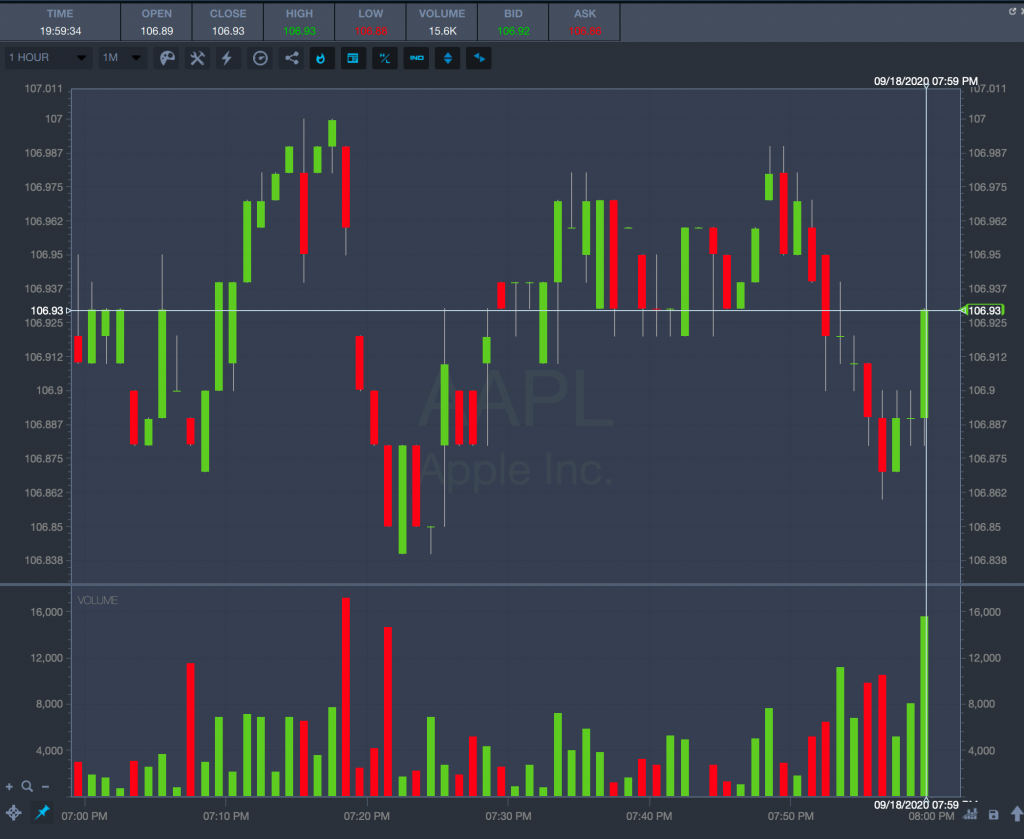

Source: StocksToTrade Apple Incorporated (AAPL: NASDAQ)

The raison d’être for using Oracle is to reduce the number of stocks you are tracking from 16 to around 3. This is where your focus should be as a stocks trader. Among others, traders get to toggle with support and resistance levels, implement, stop losses, and trade plans. Oracle looks to past performance when predicting the future performance of stocks. This gives you an indication of how much volatility to expect with these trades. We like the approach to trading at STT. They don’t sugar coat the difficulties you may face as a trader. It’s one thing buying a stock at a certain price; it is something entirely different knowing at what price you should exit your trade for a profit. Many traders get sidetracked by bullish markets, hoping for greater profits. Unfortunately, too many people sell during a bear market, accelerating losses for everyone.

What Are the Pros and Cons of StocksToTrade?

Pros

- Ideal for penny stocks trading

- Customizable trading portfolio

- Tens of thousands of stocks ready to trade

- 14-day trial for $7 to try out the STT platform

- Webinars, guides, tutorials to teach you how to trade

- Powerful trading platform with feature-rich functionality

- Oracle algorithmic function for displaying volatile stocks

- Trading platform is available to traders all over the world

Cons

- Limited to stocks

- Limited number of brokers

- Available 5 days a week during market hours only

- Costs can be high at $179.95 per month or $1899.50 for the yearly plan

What’s the Verdict with Stocks to Trade?

If you are a day trader, or you intend to become a day trader, this trading platform is packed with powerful features. It will take some time to learn the ins and outs of STT, given that it is such a powerful, visual, and immersive platform. To simplify things, traders get to use Oracle. This proprietary stocks engine automatically scans stock markets for the most volatile stocks which have the biggest potential for gains. Naturally, you will have to employ technical and fundamental analysis to improve your trades.